35+ Cost of 30 year mortgage calculator

Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This shortens their.

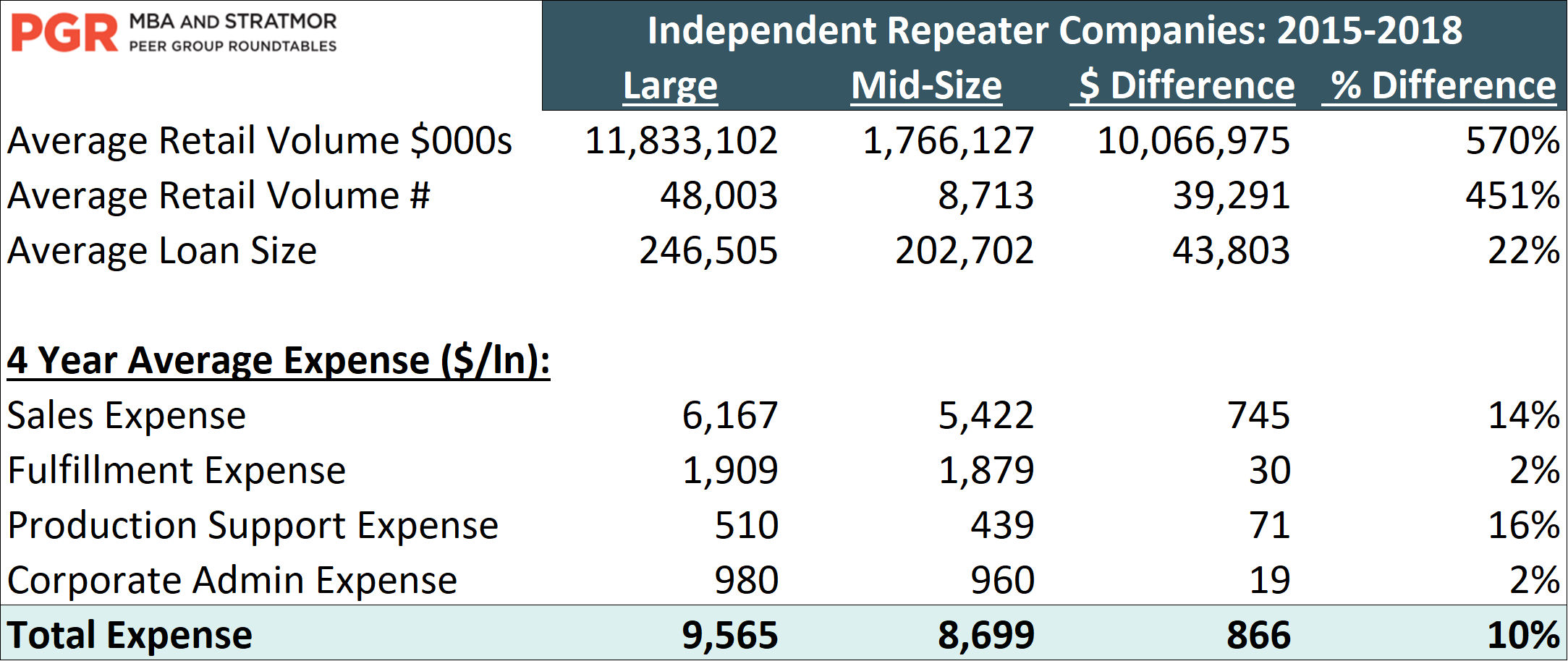

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group

When you take out a mortgage you agree to pay the principal and interest over the life of the loan.

. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years. In the example each point would cost 2000 because 1 of 200000 is equal to 2000. The most common home loan term in the US is the 30-year fixed rate mortgage.

When determining the cost of future mortgage payments home interest rates are a consequential factor for borrowers to consider. Subtract your down payment to find the loan amount. This data is based on Housing Finance at a Glance.

This would mean that if you borrowed 200000 to buy a home the annual PMI cost might range between 600 and 2400. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 359 monthly payment. A 30-year mortgage comes with a locked interest rate for the entire life of the loan.

It assumes a fixed rate mortgage rather than variable balloon or ARM. In the mortgage calculator above you can enter any amortization period ranging from 1 year to as long as 30 years. This allows you to secure a lower rate and pay your mortgage earlier.

About 28 percent of sellers agents said. Need a sample amortization schedule for a 30-year fixed mortgage. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. You can use the menus to select other loan durations alter the loan amount change your down payment or change your location. Fifteen-year loans have higher monthly payments but the home buyer pays less interest while 30-year mortgages may have lower monthly payments but the home buyer will pay more for.

The subprime mortgage credit crisis of 2007-2010 however limited lender access to the capital needed to make new loans reining in growth of the private student loan marketplace The annual increase in private student loan volume was about 25 to 35 per year compared with 8 per year for federal loan volume. The following table shows current Boydton 30-year mortgage rates. Few homes are built to last 100 years.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. 10 and 15-year terms are common for shorter mortgages while longer mortgages can have 30 or 35-year terms.

You can use a mortgage amortization calculator to see how changing your mortgages amortization period will affect your mortgage payment. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower.

Many lenders estimate the most expensive home that a person can afford as 28 of ones income. 65897 66. This mortgage calculator also lets you customize your mortgages amortization.

Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000. The PMI charge is based upon the size of the loan the size of the down-payment. Rental price 70 per night.

A shorter mortgage means youll own your home outright sooner. Use our calculator above. Assuming you have a 20 down payment 36000 your total mortgage on a 180000 home would be 144000.

To purchase 2 points this would cost 4000. Most mortgages last for 25 years but its possible to take out a mortgage for either a shorter or longer period. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

How much income you need depends on your down payment loan terms taxes and insurance. For example a 100000 30-year fixed mortgage might come with an interest rate of 3 requiring the borrower to pay an additional 3 on top of their principal loan balance. 47 followed by the master bedroom 42 and the kitchen 35.

A Monthly Chartbook released in June 2020. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30.

Both have their pros and cons. This calculates the monthly payment of a 500k mortgage based on the amount of the loan interest rate and the loan length. Choose from 30-year fixed 15-year fixed and 5-year ARM loan scenarios in the calculator to see examples of how different loan.

As for 30-year fixed-rate mortgages Urban Institute reported that it. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. The above calculator is for fixed-rate mortgages.

Cost of living comparison calculator. 1317957 132 rounded to the nearest whole number 132 months to reach your break-even point on your investment. Mortgage interest rates are always changing and there are a lot of factors that.

The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Lower interest rates compared to 30-year terms.

To estimate your break-even point more easily you can use the above calculator. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 647 monthly payment.

This free mortgage tool includes principal and interest plus estimated taxes insurance PMI and current mortgage rates. The biggest differences between 15- and 30-year loans are obvious. Because the rate stays the same expect your monthly payments to be fixed for 30 years.

With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. The cost ranges anywhere from 03 to 12 of the amount borrowed. Seller Closing Cost Calculator.

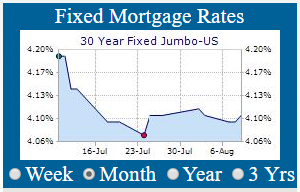

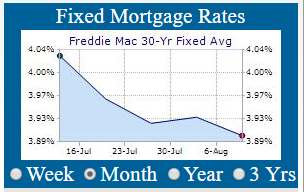

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Vectors Red Real Estate Logo Real Estate Logo Luxury Branding Design Logo Design Process

35 Costly Medical Bankruptcy Statistics Etactics

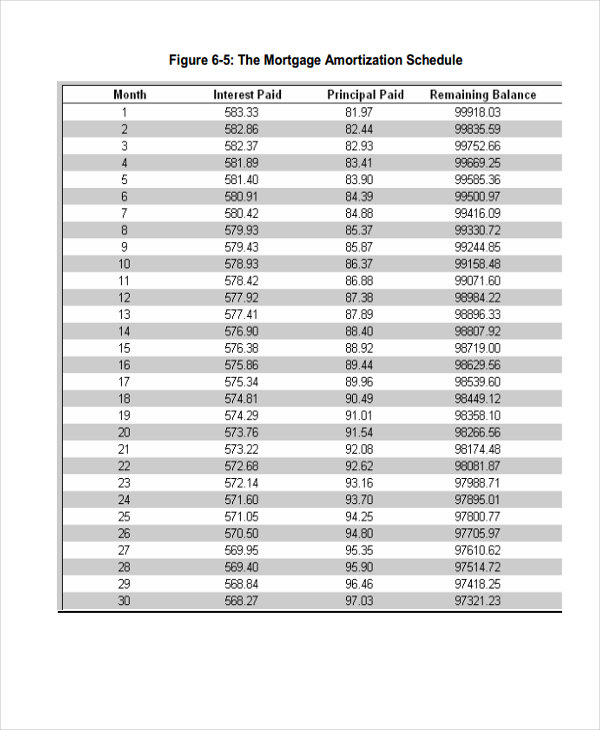

29 Amortization Schedule Templates Free Premium Templates

Will Rising Interest Rates Kill Atlanta S Hot Housing Market Atlanta Ga Patch

Waybettermortgage Explore Facebook

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Real Estate Investing

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

35 Awesome Buddha Garden Design Ideas For Calm Living Freshouz Com Zen Garden Design Buddha Garden Zen Rock Garden

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

35 Bike Storage Ideas For Small Apartments Diy Bike Rack Bike Storage Solutions Bike Storage

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Ex 99 2